Business

PLG Supplies: A Complete Guide to Smarter Growth Resources

Introduction

In today’s fast-moving business world, growth doesn’t come from guesswork or aggressive selling alone. It comes from giving people real value at the right moment. That’s where plg supplies come in. At its core, this concept is about the tools, resources, systems, and operational materials that support a product-led growth approach—where the product itself drives adoption, engagement, and expansion.

Whether you’re building a startup, scaling a SaaS platform, or modernizing an established company, understanding plg supplies can change how you think about growth. This guide breaks down what plg supplies truly mean, why they matter across industries, and how to choose them wisely. By the end, you’ll have a clear, practical framework you can actually use.

What Are PLG Supplies?

PLG supplies are the essential resources that enable a product-led growth model to function smoothly. Instead of relying heavily on sales pitches or manual outreach, product-led organizations depend on systems, tools, and support structures that let users experience value directly through the product.

Will You Check This Article: Ashcroft Capital Lawsuit: What Investors Need to Know

These supplies aren’t limited to software. They include onboarding frameworks, analytics tools, customer feedback loops, in-app support resources, operational workflows, and even internal training materials. Think of them as the invisible infrastructure that allows a product to “sell itself” through usability and outcomes.

A simple analogy helps. If the product is a vehicle, plg supplies are the fuel, dashboard, navigation system, and maintenance tools. Without them, the vehicle might move—but it won’t go far, and it certainly won’t scale.

Why PLG Supplies Matter More Than Ever

Customer expectations have changed. People want to try before they commit. They want clarity, speed, and control. Plg supplies make this possible by removing friction from the user journey and replacing it with confidence.

When organizations invest in the right supplies, they gain visibility into how users interact with their product. That insight allows teams to refine features, simplify experiences, and align internal efforts around real user behavior instead of assumptions.

More importantly, plg supplies create consistency. Every user gets a similar high-quality experience, regardless of company size or support capacity. Over time, this consistency compounds into trust, loyalty, and sustainable growth.

Core Categories of PLG Supplies

While plg supplies vary by industry and maturity level, they generally fall into a few core categories. Understanding these helps leaders identify gaps and opportunities.

Product Experience Infrastructure

This includes everything that shapes how users first encounter and navigate a product. Clear onboarding flows, guided walkthroughs, interactive demos, and contextual tips all belong here. These supplies reduce confusion and help users reach meaningful outcomes faster.

A strong product experience infrastructure often means fewer support tickets and higher engagement. Users feel empowered instead of overwhelmed, which directly impacts long-term adoption.

Data and Insight Resources

Product-led growth depends on understanding what users actually do, not what they say they’ll do. Supplies in this category include usage tracking systems, behavioral dashboards, and reporting frameworks.

When teams can clearly see where users succeed or struggle, they can make informed improvements. Over time, data becomes a shared language across departments, aligning everyone around user value.

Customer Enablement Tools

Enablement goes beyond help articles. It includes in-product messaging, self-service support, learning hubs, and feedback mechanisms. These supplies ensure users can solve problems independently while still feeling supported.

A well-designed enablement system turns customers into confident users. Confidence leads to deeper usage, which naturally opens the door to expansion.

Informational Overview of Common PLG Supplies

| Supply Category | Primary Purpose | Typical Users | Business Impact |

|---|---|---|---|

| Onboarding Systems | Guide new users to value | New customers | Faster activation |

| Usage Analytics | Track behavior and trends | Product teams | Better decisions |

| In-App Support | Reduce friction and confusion | Active users | Higher retention |

| Feedback Channels | Capture user insights | All users | Continuous improvement |

This table highlights how different plg supplies work together. No single supply drives growth alone. Their real power comes from integration and alignment.

PLG Supplies Across Different Industries

One of the strengths of plg supplies is their adaptability. While the concept originated in software, its principles apply broadly.

In education platforms, supplies might include interactive lessons, progress dashboards, and self-assessment tools. These resources help learners see progress quickly, increasing motivation.

In financial services, plg supplies can include intuitive calculators, real-time insights, and guided setup experiences. When users feel in control of complex information, trust grows naturally.

Even physical product companies use similar ideas. Clear setup guides, digital companions, and usage insights all function as plg supplies by helping customers get value without constant assistance.

How PLG Supplies Support Long-Term Growth

Short-term wins are easy. Sustainable growth is harder. Plg supplies play a key role by creating systems that scale without burning out teams.

As user numbers grow, manual support becomes inefficient. Well-designed supplies absorb that load by answering questions, guiding actions, and highlighting opportunities automatically. This allows teams to focus on innovation instead of firefighting.

Another long-term benefit is predictability. When growth is driven by product usage, leaders can forecast more accurately. Decisions become proactive rather than reactive, which stabilizes operations over time.

Choosing the Right PLG Supplies for Your Organization

Not every supply fits every company. Choosing wisely requires clarity about goals and constraints.

Start by mapping the user journey from first contact to long-term usage. Identify points where users hesitate, drop off, or seek help. These moments reveal which supplies will deliver the most impact.

It’s also important to consider internal readiness. Supplies only work when teams understand and trust them. Investing in training and alignment ensures that tools enhance collaboration instead of adding noise.

Finally, prioritize integration. Disconnected supplies create fragmented experiences. Unified systems tell a coherent story, both for users and internal teams.

Common Mistakes When Implementing PLG Supplies

Many organizations rush into adoption without strategy. One common mistake is overloading users with too many features at once. Even helpful supplies can become overwhelming if introduced without context.

Another issue is ignoring qualitative feedback. Numbers tell part of the story, but conversations and open responses reveal emotions and motivations. Balanced insight leads to better decisions.

Some teams also underestimate maintenance. Plg supplies aren’t “set and forget.” They require regular review to stay aligned with evolving user needs.

Real-World Example: From Friction to Flow

Consider a mid-sized digital platform struggling with low trial conversions. Users signed up but rarely reached meaningful outcomes. Instead of increasing outreach, the team focused on upgrading their plg supplies.

They simplified onboarding, added contextual guidance, and introduced usage dashboards for internal teams. Within months, users reached value faster, support requests dropped, and conversions increased steadily.

The key lesson wasn’t technology alone. It was intentional design supported by the right supplies at the right time.

Conclusion

PLG supplies are more than tools or resources. They are the foundation that allows products to drive growth naturally and sustainably. By focusing on user experience, insight, and enablement, organizations create systems that scale with confidence.

The most successful teams treat these supplies as strategic assets, not afterthoughts. They invest thoughtfully, integrate deeply, and refine continuously. When done right, plg supplies transform growth from a constant struggle into a repeatable process.

If you’re aiming for smarter, more resilient growth, start by examining the supplies behind your product. Small improvements there often lead to the biggest results.

Frequently Asked Questions (FAQs)

What does PLG stand for in plg supplies?

PLG stands for product-led growth, a model where the product itself drives user adoption, engagement, and expansion.

Are plg supplies only relevant for software companies?

No. While common in software, the principles apply to education, finance, and even physical products that rely on user experience.

How many plg supplies does a company need?

There’s no fixed number. The right selection depends on user needs, product complexity, and growth goals.

Can small teams benefit from plg supplies?

Yes. In fact, small teams often see faster impact because these supplies reduce manual effort and scale efficiently.

How often should plg supplies be reviewed or updated?

Regular reviews are essential. Many teams reassess quarterly to ensure alignment with user behavior and business direction.

Business

Why Businesses Are Choosing Call Center Outsourcing With Garage2Global in 2025

Call center outsourcing with Garage2Global has emerged as a practical solution for businesses seeking cost efficiency without compromising customer experience. In today’s fast-paced digital culture, brands are expected to stay responsive, human, and always available. That expectation creates pressure on internal teams, especially for growing companies. Outsourcing bridges this gap by blending operational discipline with modern communication tools. Garage2Global positions itself at this intersection of tradition and innovation, offering structured call support while adapting to evolving customer behavior. As global businesses look beyond borders for scalable support, outsourcing models like this reflect a shift toward smarter resource allocation, cultural flexibility, and performance-driven service delivery.

People Read this one also: Fintechzoom.com Business

What Is Call Center Outsourcing and Why It Matters

Call center outsourcing is the practice of delegating customer communication tasks to a specialized external team. Instead of building in-house infrastructure, businesses rely on trained agents to handle inbound support, outbound calls, and customer engagement. This model gained relevance as customer expectations evolved toward instant responses and omnichannel availability. Garage2Global enters this space as a service provider focused on helping companies manage customer interactions efficiently. The relevance lies in balance—maintaining a human touch while using modern systems like CRMs, call analytics, and workflow automation. For many brands, outsourcing is no longer a cost-cutting tactic; it’s a strategic decision to ensure consistent service quality at scale.

How Call Center Outsourcing With Garage2Global Works

Call center outsourcing with Garage2Global typically begins with understanding a client’s communication needs, call volume, and brand tone. Based on this, trained agents are assigned to act as an extension of the business. Semantic practices like omnichannel support, CRM-based workflows, and performance monitoring are integrated into daily operations. LSI concepts such as virtual receptionists, lead qualification, and customer retention naturally fit into this model. Instead of rigid scripts, the focus leans toward contextual conversations. This structure allows businesses to maintain consistency while remaining flexible enough to adapt to seasonal demand or sudden growth.

Service Quality, Reliability, and Expert Perspective

A major concern with outsourcing is quality control. Garage2Global emphasizes process alignment, agent training, and regular performance reviews to reduce this risk. According to industry professionals, outsourcing succeeds when communication standards and accountability are clearly defined from day one. This insight reflects a broader BPO trend: clients value transparency as much as affordability. Quality assurance mechanisms, call audits, and feedback loops help maintain reliability. Over time, this structured approach supports long-term partnerships rather than short-term transactions, which is critical in customer-centric industries.

Cost Efficiency Without Compromising Experience

One of the strongest arguments for outsourcing is financial efficiency. Businesses reduce overhead related to hiring, training, infrastructure, and management. However, savings alone do not sustain growth. The real value comes when cost efficiency aligns with customer satisfaction. Garage2Global’s outsourcing model focuses on optimized staffing and scalable operations, allowing companies to pay for what they actually use. Semantic keywords like operational flexibility, resource optimization, and service scalability fit naturally here. This balance ensures customers still feel heard, respected, and supported—an outcome that directly impacts brand loyalty.

Technology, Tools, and Operational Integration

Modern call centers rely heavily on technology. Garage2Global integrates tools such as CRM platforms, call tracking systems, and performance dashboards to ensure smooth operations. These tools help monitor response times, resolution rates, and customer feedback in real time. From an SEO-relevant perspective, this reflects digital transformation in customer support. Related topics you may explore on our site include business outsourcing strategies, customer experience management, and digital operations optimization. The integration of technology ensures outsourcing feels seamless rather than detached from the core business.

Scalability and Long-Term Business Growth

Outsourcing is not static; it evolves with the business. As companies expand into new markets or experience seasonal spikes, call center capacity must adjust quickly. Garage2Global’s model supports this scalability without forcing clients to restructure internally. Semantic concepts like growth enablement, adaptive staffing, and long-term planning are central here. This flexibility empowers businesses to focus on strategy and innovation while customer communication remains stable. Over time, scalable outsourcing becomes a foundation for sustainable growth rather than a temporary fix.

Building Trust in an Outsourced Environment

Trust is built through consistency, transparency, and results. In outsourced call center relationships, trust grows when agents genuinely represent the brand’s values. Garage2Global emphasizes alignment between client expectations and agent behavior. Traditional customer service values—politeness, patience, clarity—merge with a futuristic outlook driven by data, automation, and analytics. This blend ensures customers experience warmth alongside efficiency, reinforcing trust across every interaction.

The Future of Outsourced Customer Support

The future of call center outsourcing is increasingly hybrid. Human agents supported by AI tools, predictive analytics, and automation will define the next phase. Garage2Global’s positioning within this evolving landscape reflects a shift toward smarter outsourcing rather than volume-based call handling. Businesses that embrace this model gain resilience in uncertain markets. The combination of cultural understanding and technological advancement ensures outsourced support remains relevant in a rapidly changing global economy.

Conclusion

Call center outsourcing with Garage2Global represents more than an operational choice; it reflects a strategic mindset focused on efficiency, scalability, and customer trust. By combining structured processes with modern tools and human-centric service, businesses can maintain strong customer relationships without overstretching internal resources. As markets grow more competitive, outsourcing models like this offer a sustainable path forward—one where innovation supports tradition, and growth remains grounded in meaningful customer connections.

FAQs

1. What types of businesses benefit most from call center outsourcing?

Startups, SMEs, and growing enterprises benefit most because outsourcing reduces operational load while ensuring professional customer support without heavy upfront investment.

2. Does outsourcing affect brand identity?

When properly managed, outsourcing strengthens brand identity by maintaining consistent communication standards and trained agents aligned with brand values.

3. Is call center outsourcing cost-effective long term?

Yes. Over time, businesses save on infrastructure, staffing, and training while gaining scalable support that adapts to demand.

4. How is quality monitored in outsourced call centers?

Quality is maintained through call monitoring, performance metrics, customer feedback, and continuous agent training programs.

5. Can outsourced teams handle complex customer issues?

With proper onboarding and system access, outsourced agents can manage complex queries efficiently while escalating issues when required.

Read More About Techicize.com

Business

Fintechzoom.com Business: A New Way to Understand Markets

In a time when financial decisions are shaped by real-time data and global connectivity, fintechzoom.com business has positioned itself as a modern information hub for market-focused readers. From seasoned traders to everyday users curious about stocks, indexes, and investing trends, people now rely on digital platforms that explain finance clearly and responsibly. This shift reflects a broader cultural evolution—money conversations are no longer elite or hidden; they are public, practical, and constant. Fintech-focused platforms respond to this demand by combining traditional financial understanding with modern technology-driven insights. Within this space, fintechzoom.com business stands out by covering markets, global indexes, and investment themes in a structured, reader-friendly way. This article explores how different sections of the platform—markets, lifestyle, indexes, and investments—work together to create a complete financial knowledge ecosystem.

People Read this one also:Escapamento rd

What Is Fintechzoom.com Business?

FintechZoom business is the market and economy-focused segment of a broader digital finance platform. It delivers news, analysis, and explainers related to global stock markets, economic indicators, and investment strategies. What makes it relevant is its balance between depth and accessibility. Instead of assuming expert-level knowledge, it guides readers step by step through market movements, index performance, and financial trends. The platform reflects how finance is experienced today—fast, global, and interconnected. By combining market data with contextual explanations, fintechzoom.com business helps readers understand not just what is happening, but why it matters. This human-centered approach has increased its appeal across different experience levels.

fintechzoom.com lifestyle and the Human Side of Finance

The fintechzoom.com lifestyle section highlights how financial decisions influence everyday living. Rather than focusing only on charts and numbers, this area connects money with work culture, personal growth, and modern habits. It explores how economic shifts affect spending behavior, digital careers, and long-term planning. By integrating lifestyle perspectives, the platform shows that finance is not isolated from daily life. Readers gain insight into how inflation, income trends, and technology impact real people. This human-focused content also supports broader financial understanding by grounding abstract concepts in relatable experiences. fintechzoom.com lifestyle appears again across articles where market changes are tied to consumer behavior, reinforcing the idea that finance is lived, not just calculated.

fintechzoom.com markets as a Global Financial Overview

fintechzoom.com markets acts as the backbone of the platform, offering readers a panoramic view of global financial activity. This section tracks movements across equities, commodities, currencies, and economic indicators. Instead of presenting raw data alone, it explains market reactions and underlying causes. According to industry professionals, readers benefit most when market coverage includes context rather than short-term speculation. fintechzoom.com markets follows this principle by linking events such as policy changes or geopolitical developments to price movements. This approach builds confidence among readers who want understanding, not noise. fintechzoom.com markets is referenced throughout related content, reinforcing consistency and topical depth.

fintechzoom.com nasdaq and Growth-Oriented Market Coverage

The fintechzoom.com nasdaq coverage focuses on technology-driven companies and growth-focused sectors. Nasdaq-related articles often analyze innovation trends, earnings momentum, and investor sentiment around tech stocks. Rather than promoting hype, the platform explains volatility and long-term implications clearly. fintechzoom.com nasdaq appears in discussions about digital transformation, startups, and emerging industries, helping readers see how innovation shapes market performance. By revisiting fintechzoom.com nasdaq in broader market contexts, the platform connects tech growth with overall economic direction.

fintechzoom.com dow and Market Stability Insights

fintechzoom.com dow centers on blue-chip companies and traditional market strength. Dow-related analysis often highlights stability, dividends, and long-term performance indicators. This section appeals to readers interested in established businesses rather than rapid growth alone. fintechzoom.com dow content explains how legacy companies respond to economic cycles, interest rates, and global demand. By revisiting fintechzoom.com dow across market summaries, the platform reinforces the importance of balance between growth and stability in portfolio thinking.

fintechzoom.com ftse 100 and UK Market Perspective

The fintechzoom.com ftse 100 section provides insight into the United Kingdom’s leading companies and broader European economic signals. Coverage often links currency movements, energy prices, and international trade to index performance. fintechzoom.com ftse 100 appears again in comparative analysis with other global indexes, helping readers understand regional differences. This repeated contextual use strengthens reader awareness of how local economies connect to global finance.

fintechzoom.com stoxx 600 and fintechzoom.com cac 40 in Europe

European markets receive focused attention through fintechzoom.com stoxx 600 and fintechzoom.com cac 40 coverage. These sections explain sector-wide European trends and country-specific dynamics. fintechzoom.com stoxx 600 highlights cross-border performance, while fintechzoom.com cac 40 dives into France’s leading firms. Both appear again in broader European market discussions, reinforcing regional understanding and helping readers compare performance across borders.

fintechzoom.com bonds and fintechzoom.com investments Explained

fintechzoom.com bonds content explores fixed-income markets, interest rate movements, and risk management strategies. It explains why bonds matter during uncertainty and how they balance portfolios. Alongside this, fintechzoom.com investments covers broader asset allocation, long-term planning, and strategic decision-making. fintechzoom.com investments appears again when discussing diversification, tying together stocks, bonds, and indexes into one coherent strategy. Related topics you may explore on our site include investment planning, global markets, and financial education.

Conclusion

By combining markets, indexes, and human-focused insights, fintechzoom.com business delivers a complete financial narrative for modern readers. Its structured coverage—from lifestyle and markets to bonds and investments—helps users understand finance as an interconnected system rather than isolated data points. As global economies evolve, platforms that prioritize clarity, balance, and context will remain essential. fintechzoom.com business continues to grow by respecting both traditional financial principles and future-oriented thinking, empowering readers to make informed, confident decisions.

FAQs

1. What does fintechzoom.com markets focus on?

It covers global market movements, including stocks, commodities, and economic indicators, with contextual explanations for better understanding.

2. How is fintechzoom.com nasdaq different from dow coverage?

Nasdaq content focuses on growth and technology, while dow coverage emphasizes stability and established companies.

3. Why does fintechzoom.com include lifestyle content?

Lifestyle content connects finance with daily life, showing how economic trends affect real-world decisions.

4. Are European markets covered on fintechzoom.com?

Yes, through sections like stoxx 600, cac 40, and ftse 100, offering regional and comparative insights.

5. Does fintechzoom.com investments help beginners?

Absolutely. It explains investment concepts clearly, focusing on long-term strategy and risk awareness.

Read More About Techicize.com

Business

5StarsStocks.com Stocks Guide: What Makes a Stock Truly Worth Buying

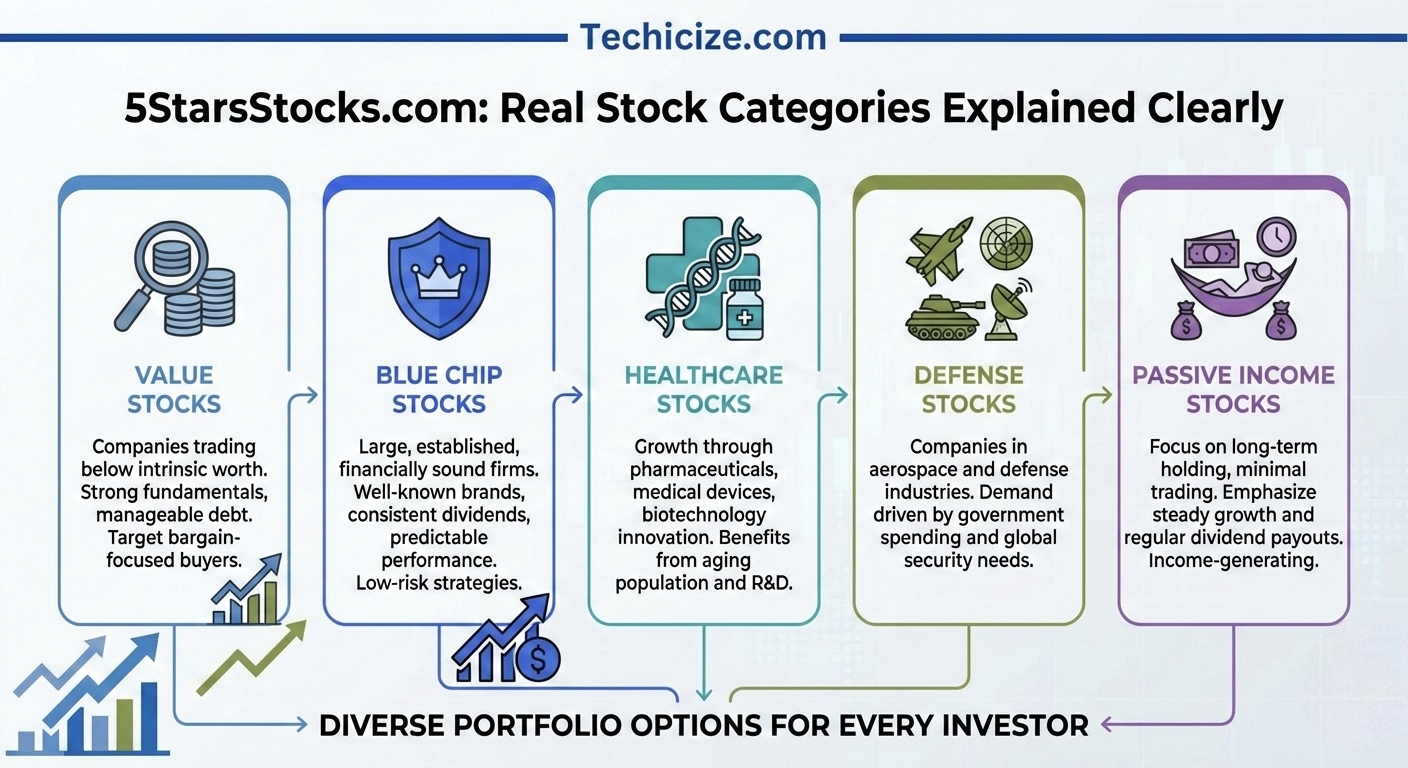

In the evolving world of digital investing, platforms that simplify research while maintaining analytical depth are gaining rapid attention. Among them, 5starsstocks.com stocks stand out for investors who want clarity, structure, and category-based insights instead of random stock tips. From long-term value investing to sector-focused strategies like healthcare and defense, modern investors want organized information that matches their financial goals.

This article explains 5StarsStocks.com best stocks by focusing on real stock categories that investors actually analyze in financial markets. Instead of vague claims, it looks at how stocks are grouped based on practical investing needs such as buying opportunities identified through valuation and trends, passive income stocks backed by consistent dividends, and blue-chip stocks known for long-term stability and strong fundamentals. These categories reflect how professional and retail investors search, compare, and evaluate stocks in real-world scenarios. Each section is built on market logic, sector performance, and investor behavior, ensuring the content remains informative, realistic, and genuinely useful for readers who want structured stock insights rather than speculation.

People Read this one also: Call center outsourcing with Garage2Global

What Is 5StarsStocks.com?

5StarsStocks.com is a stock-focused research platform concept built around simplified analysis, categorized investing, and performance-based insights. Instead of overwhelming users with raw financial data, it highlights stock strength through logical groupings such as value, passive, and sector-specific equities.

The platform’s relevance comes from how modern investors search today. People no longer look for just “stocks”; they look for why a stock fits their strategy. By organizing insights around investment intent, it supports smarter decision-making and long-term discipline. This approach appeals to both new investors learning fundamentals and experienced traders seeking clarity without noise.

5StarsStocks.com to Buy: How Investors Identify Entry Opportunities

When users search 5starsstocks.com to buy, they are usually looking for stocks that show favorable entry signals rather than hype-driven picks. This keyword reflects intent-based investing—identifying stocks with balanced valuation, trend confirmation, and reasonable risk exposure.

On platforms like this, buying insights are typically shaped around momentum strength, recent consolidation patterns, and sector relevance. Instead of timing the exact bottom, investors focus on probability-based entries. Using 5starsstocks.com to buy as a research lens encourages patience and confirmation, which reduces emotional trading. Repeating 5starsstocks.com to buy searches shows growing demand for structured buying logic rather than impulsive decisions.

5StarsStocks.com Value Stocks: Long-Term Wealth Thinking

5starsstocks.com value stocks attract investors who prioritize fundamentals over short-term price swings. Value stocks are generally associated with stable earnings, reasonable price-to-earnings ratios, and established business models.

Within the context of 5starsstocks.com value stocks, the focus remains on identifying underappreciated companies with long-term growth potential. These stocks often perform well during uncertain market conditions because they are backed by real revenue and operational strength. According to industry professionals, value-based strategies tend to outperform speculative trends over longer market cycles. That’s why 5starsstocks.com value stocks continue to gain consistent search interest among disciplined investors.

5StarsStocks.com Military: Defense Sector Investment Logic

Searches for 5starsstocks.com military indicate interest in defense-related stocks tied to national security, aerospace, and military technology. These stocks often benefit from long-term government contracts and budget-driven stability.

The 5starsstocks.com military category reflects a sector-focused mindset where investors analyze geopolitical trends, defense spending cycles, and technological innovation. Military stocks are generally less sensitive to consumer demand fluctuations, which makes 5starsstocks.com military a popular keyword during periods of global uncertainty. This category appeals to investors seeking resilience rather than rapid growth.

5StarsStocks.com Passive Stocks: Building Income With Stability

The keyword 5starsstocks.com passive stocks aligns with investors who want steady returns without frequent trading. Passive stocks often include dividend-paying companies, low-volatility equities, and businesses with predictable cash flow.

Within 5starsstocks.com passive stocks, the emphasis is on consistency rather than excitement. These stocks are suitable for individuals planning retirement portfolios or long-term income strategies. By focusing on 5starsstocks.com passive stocks, investors shift from short-term speculation to sustainable wealth building. This keyword continues to grow as more people seek financial stability over aggressive risk.

5StarsStocks.com Blue Chip: Trust and Market Leadership

5starsstocks.com blue chip searches reflect trust-based investing. Blue-chip stocks represent industry leaders with strong balance sheets, global recognition, and long operational histories.

Using 5starsstocks.com blue chip as a research category highlights companies known for stability during market downturns. These stocks are commonly included in institutional portfolios due to their reliability. Investors searching 5starsstocks.com blue chip typically value capital preservation alongside moderate growth, making this category essential for conservative and balanced portfolios.

5StarsStocks.com Healthcare: Defensive Growth Sector

The 5starsstocks.com healthcare keyword represents interest in one of the most resilient market sectors. Healthcare stocks include pharmaceuticals, medical devices, biotech, and healthcare services—industries driven by long-term demand rather than economic cycles.

Investors exploring 5starsstocks.com healthcare often look for innovation combined with defensive strength. Aging populations, medical advancements, and consistent demand make healthcare a strategic investment area. Repeated searches for 5starsstocks.com healthcare indicate growing awareness of sector-based diversification as part of a balanced investment approach.

Future of Category-Based Stock Research

Category-focused investing reflects how investor behavior is evolving. Instead of chasing random tips, people want structured pathways aligned with their goals—whether that’s buying opportunities, value preservation, or passive income.

Related topics you may explore on our site include long-term investing strategies, stock market education, and portfolio diversification concepts. As digital research tools advance, platforms that organize insights by intent and sector will remain relevant and trusted.

Conclusion

The growing popularity of 5starsstocks.com stocks highlights a shift toward smarter, intent-based investing. Whether investors are searching for buying opportunities, value stocks, military exposure, passive income, blue-chip stability, or healthcare resilience, the demand is clear: clarity matters.

By focusing on structured categories instead of speculation, investors gain confidence and direction. The future of investing belongs to those who combine traditional wisdom with modern research tools—and category-based stock analysis plays a central role in that journey.

FAQs

1. What does “5starsstocks.com to buy” usually mean?

It refers to identifying stocks with favorable entry conditions based on trend strength, valuation, and market confirmation rather than impulsive buying.

2. Are 5starsstocks.com value stocks good for beginners?

Yes. Value stocks are often more stable and easier to understand, making them suitable for beginners focused on long-term growth.

3. Why are military stocks considered stable investments?

Defense companies often rely on long-term government contracts, making revenue more predictable during economic uncertainty.

4. What makes passive stocks different from growth stocks?

Passive stocks focus on steady income and low volatility, while growth stocks prioritize rapid expansion and higher risk.

5. Is healthcare a defensive investment sector?

Yes. Healthcare demand remains consistent regardless of economic conditions, making it a popular defensive investment choice.

Read more About Techicize.com